how long can the irs legally collect back taxes

This means that the IRS has 10 years after assessment to collect any taxes you owe. Schedule payments up to 30 days in advance and receive instant confirmation that you submitted your payment.

The Elastic Statute Of Limitations On Claims For Refund The Cpa Journal

This is called the IRS Statute of.

. The reason the statute of limitations has such a big impact is because it is used to determine the likelihood the taxing authority has of being able to collect the entire tax debt. The ten-year time period in which the IRS can collect back taxes begins on the date an IRS official signs the tax assessment. This is called the 10 Year Statute of Limitations.

Instead the clock for the 10 years begins when the IRS notices your missing return you file the return to get caught up with your taxes or the IRS files and submits a substitute return on your behalf. This 10-year limit is known as the collection statute expiration date CSED and it frees tens of thousands of Americans from their tax liabilities every year. Fortress Tax Relief Tax Relief Services.

This law is known as the statute of limitations. As a general rule there is a ten year statute of limitations on IRS collections. The IRS has 10 years to collect the full amount from the day a tax liability is finalized plus any penalties and interest.

The Internal Revenue Code tax laws allows the IRS to collect on a delinquent debt for ten years from the date a return is due or the date it is actually filed whichever is later. Theres a problem with your tax account at the IRS. After that the debt is wiped clean from its books and the IRS writes it off.

The time to audit taxes can be extended. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. In general the IRS has 10 years after the date of assessment to collect on delinquent taxes and tax-related fees although there are a few exceptions.

This means that the maximum period of time that the IRS can legally collect back taxes is 10 years from the date which they are owed. This is a general rule however and the collection period can be suspended for various reasons thus extending how long the IRS has to collect your debt. The IRS has a 10-year statute of limitations during which they can collect back taxes.

You have one or more unfiled back tax returns. Access information on the tax collection process for late filling or paying back taxes. If you have unfiled back tax returns the IRS can start a delinquent return inquiry and freeze your refund until youve filed all your back tax returns and paid any associated tax bills.

However if you are getting notices from the IRS and you are wondering if they will ever go away the answer is yes. The good news is that the IRS has a number of years in which they can try to collect back taxes from you. There is an IRS statute of limitations on collecting taxes.

The Collection Process and Taxpayer Rights The Collection Process IRS Notices and Bills Penalties and Interest Charges. Secure ways to pay your taxes. The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection activities against you.

The IRS has a three year period to issue a refund or audit a tax return while they have ten years to collect any unpaid taxes. The time period called statute of limitations within which the IRS can collect a tax debt is generally 10 years from the date the tax was officially assessed. It is true that the IRS can only collect on tax debts that are 10 years or younger.

The remaining balance disappears forever if the IRS doesnt collect the full amount within the 10-year period because the statute of limitations has expired. The statute of limitations puts a time limit on almost every tax-related action of taxpayers and the IRS. A tax assessment determines how much you owe.

As a general rule there is a ten year statute of limitations on IRS collections. For most cases the IRS has 3 years from the date the return was filed to audit a tax return and determine if additional tax is due. IRS Direct Pay IRS Direct Pay is free and available at IRSgovDirectPay where you can securely pay your taxes directly from your checking or savings accounts without any fees or pre-registration.

How long can the IRS collect back taxes. If you owe back taxes to the Internal Revenue Service IRS you may be wondering how long they can collect them. This means that the IRS can attempt to collect your unpaid taxes for up to ten years from the date they were assessed.

There is a 10-year statute of limitations on the IRS for collecting taxes. The IRS 10 year window to collect starts when the IRS originally determines that you owe taxes that is usually when you filed your tax return or when the result of an IRS audit. It is not in the financial interest of the IRS to make this statute widely known.

Section 6672 of the tax code puts a 100 penalty on responsible persons who fail to withhold or who withhold but fail to hand it over to the. Last Updated March 25 2022. If you did not file a tax return the IRS will create a return and file deficiency assessment which will begin the ten-year statute of limitations.

Subject to some important exceptions once the ten years are up the IRS has to stop its collection efforts. Subject to some important exceptions once the ten years are up the IRS has to stop its collection efforts. However that 10 years does not begin when you neglect either accidentally or willfully to file your return.

This means that the IRS can attempt to collect your unpaid taxes for up to ten years from the date they were assessed. How long can the IRS collect on my debt. How Long Can the IRS Collect Back Taxes.

In the case of the IRS if the full 10 years remains to collect the tax debt the IRS may be less willing to accept an Offer In Compromise or a payment plan that will not satisfy the entire liability.

When It Comes To The Law No One Is Above It That Goes For Celebrities Too No Matter How Famous They Are In Social Media Infographic Infographic Celebrities

Does The Irs Forgive Tax Debt After 10 Years Heartland Tax Solutions

What You Shouldn T Do If You Owe The Irs Smartasset

How Far Back Can The Irs Collect Unfiled Taxes

Fillable Form 433 F 2017 Internal Revenue Service Fillable Forms Form

Amazon Had Sales Income Of 44bn In Europe In 2020 But Paid No Corporation Tax Amazon The Guardian

What Assets Can The Irs Legally Seize To Satisfy Tax Debt Paladini Law

How Long Can The Irs Try To Collect A Debt

Tas Tax Tip Understanding Your Csed And The Time Irs Can Collect Taxes

Andrew Gordon Is A Tax Court Lawyer Andrew An Expert On The Tax Law And Tax Court S Rules And Procedures Winning Is What Tax Lawyer Rules And Procedures Etax

Employee Or Contractor It S Not A Matter Of Choice Gig Economy Payroll Taxes Contractors

Does The Irs Forgive Tax Debt After 10 Years

Are There Statute Of Limitations For Irs Collections Brotman Law

How To Become Tax Compliant As An Accidental American Myexpattaxes

Andrew Gordon Is A Tax Court Lawyer Andrew An Expert On The Tax Law And Tax Court S Rules And Procedures Winning Is What Tax Lawyer Rules And Procedures Etax

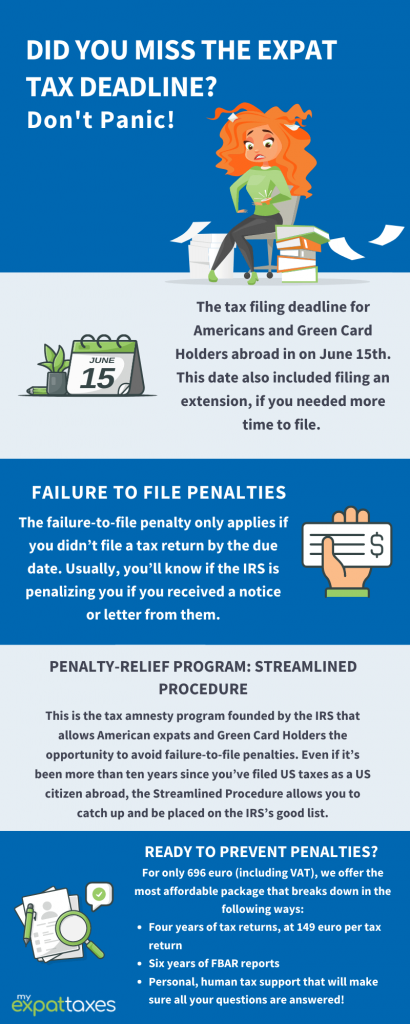

Missed The Expat Tax Deadline In 2022 Myexpattaxes

When Does An Irs Tax Lien Expire Rjs Law Tax And Estate Planning

Missed The Expat Tax Deadline In 2022 Myexpattaxes

How To Become Tax Compliant As An Accidental American Myexpattaxes